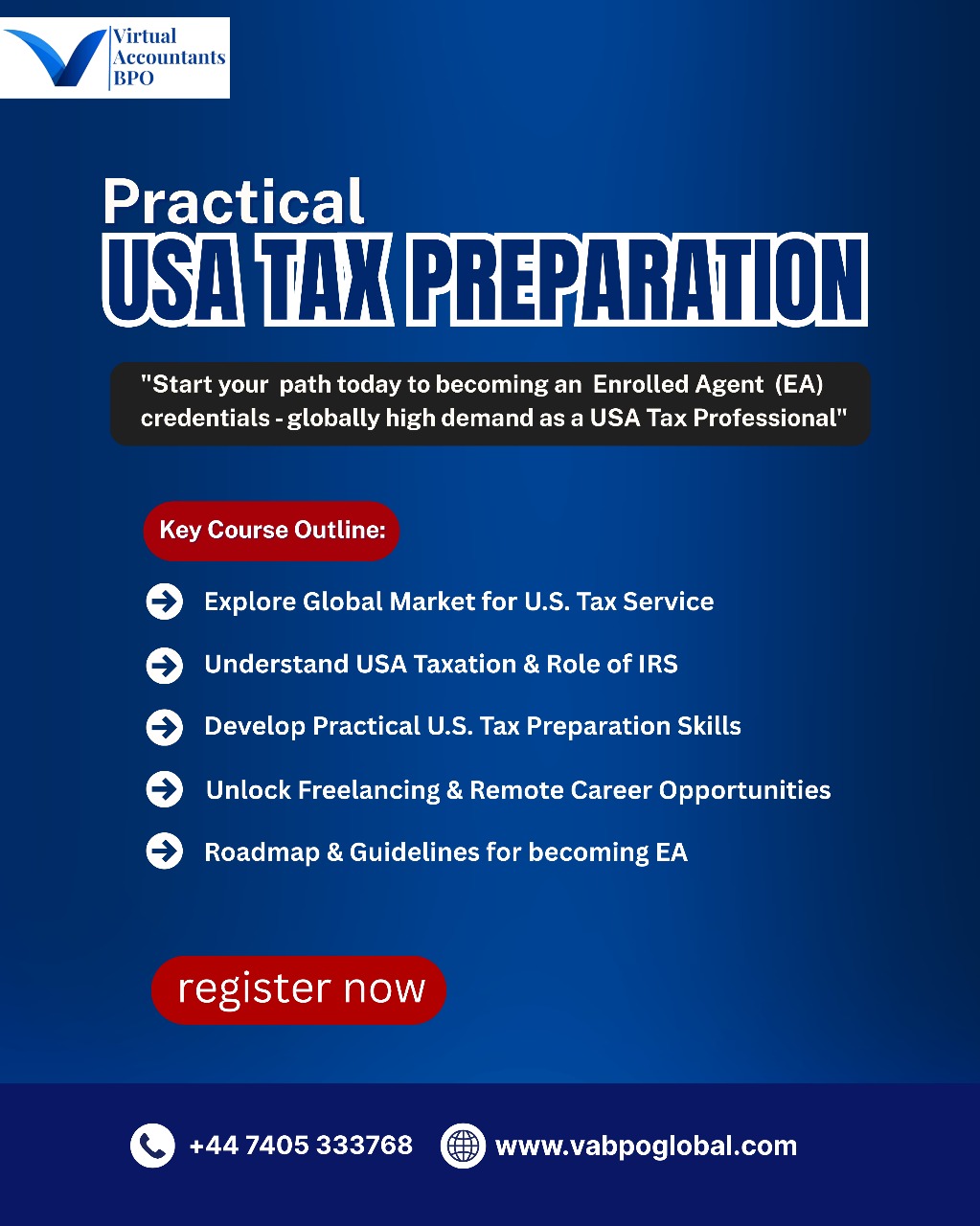

About Course

Master 1040, 1065, 1120, IRS compliance, and U.S. business structures with a complete recorded course. Includes FREE International Bookkeeping training.

⭐ WHY THIS COURSE?

The global demand for skilled U.S. tax preparers is growing every year. Thousands of U.S. individuals and businesses outsource tax preparation to remote professionals worldwide.

This recorded course helps you learn step-by-step, gain real client experience, and start dollar-earning freelancing from home.

Student Ratings & Reviews

No Review Yet